Missoula Real Estate Market Overview For 2022

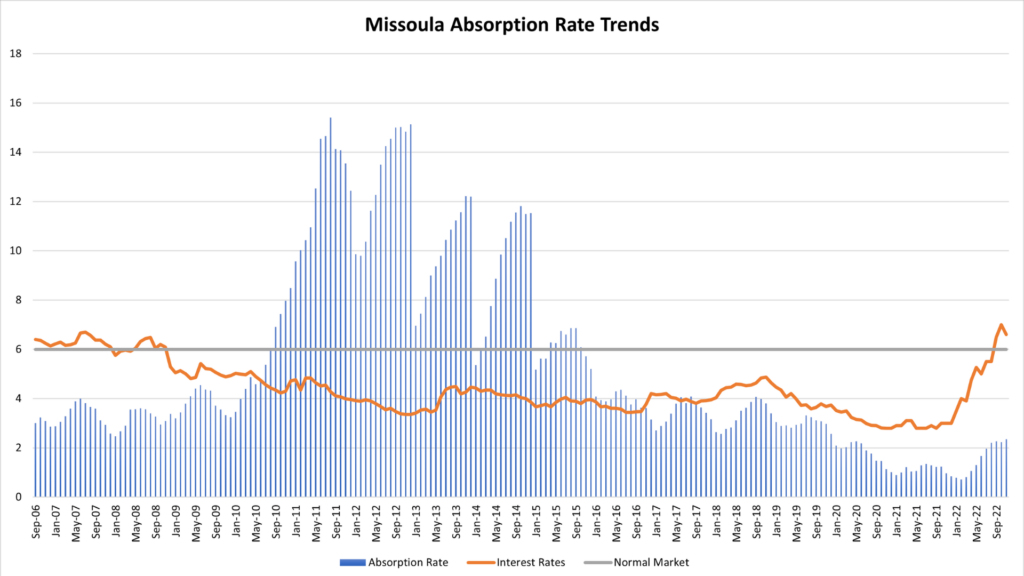

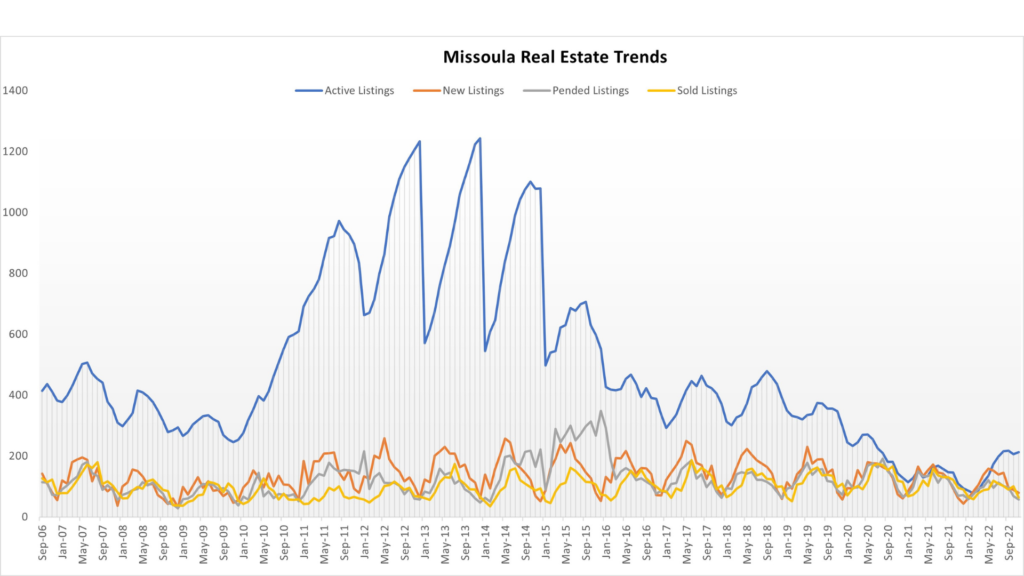

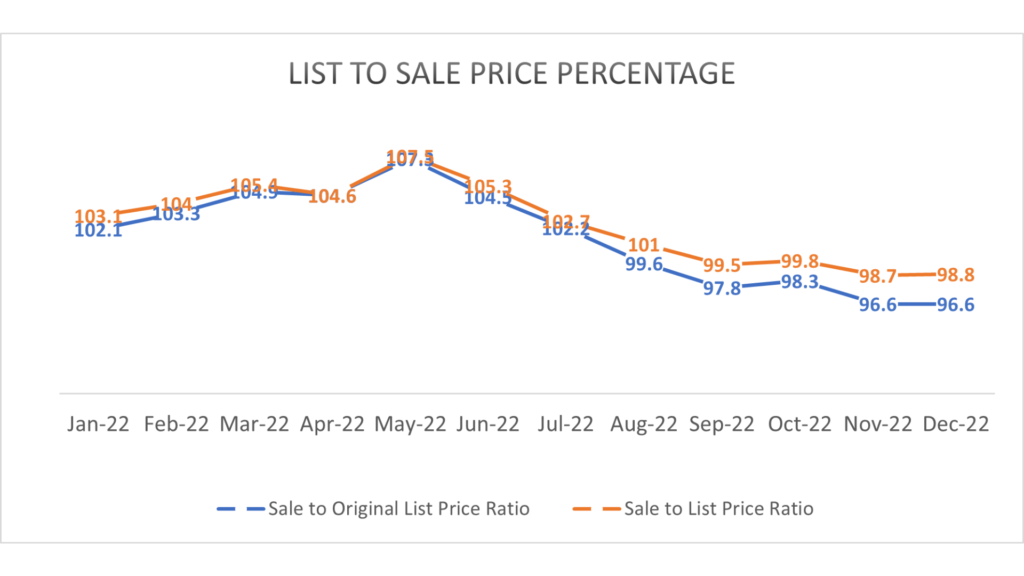

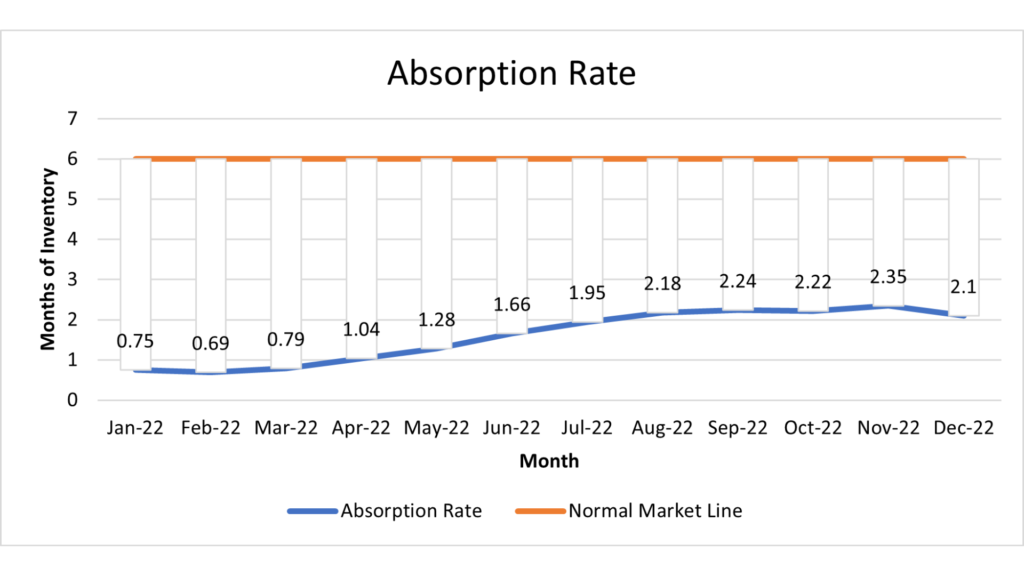

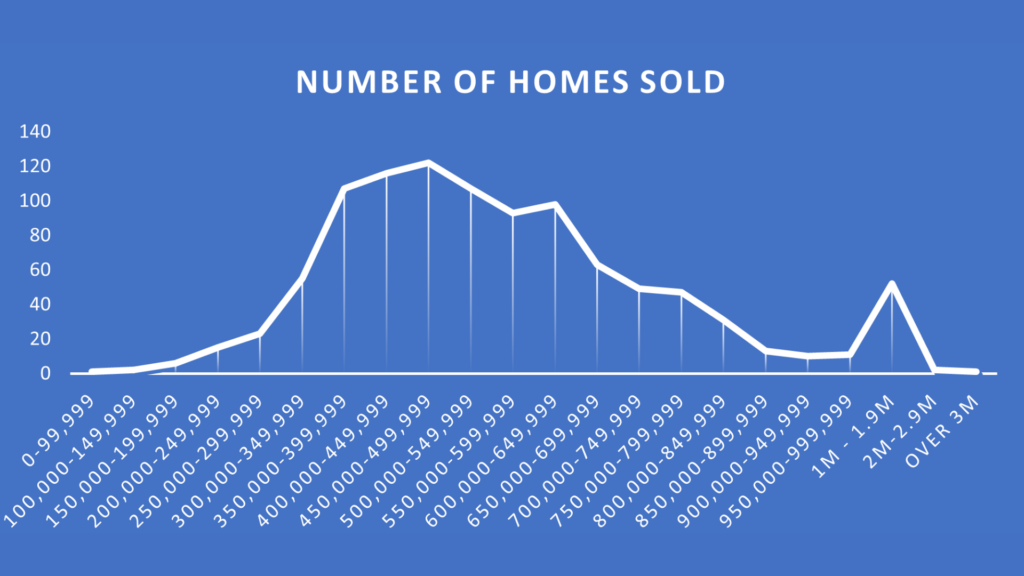

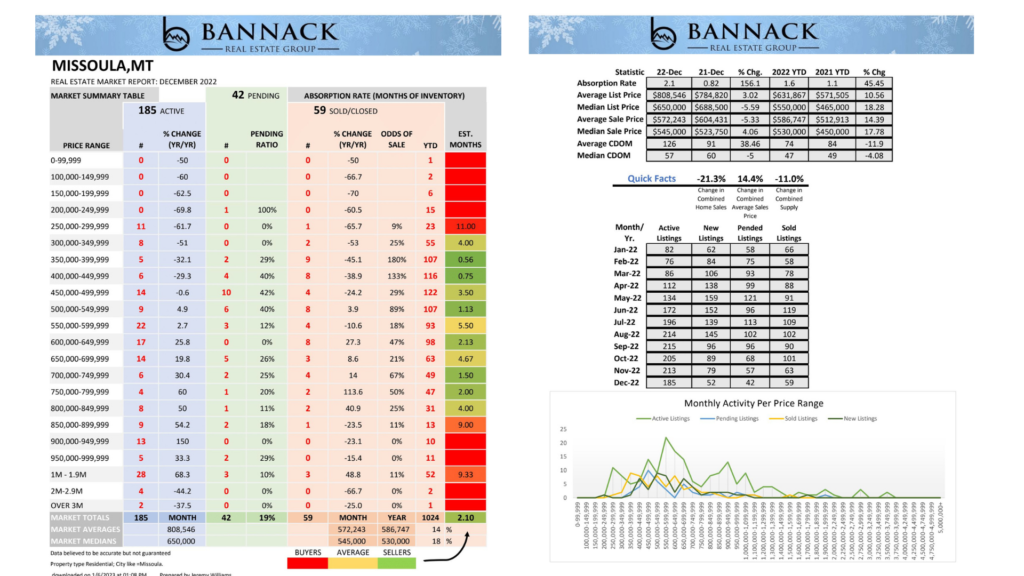

The Missoula real estate market in 2022 was a tale of two markets. It started as an extreme seller’s market with low-interest rates and inventory. Sellers were getting great offers for their homes and appreciation was still high. Buyers were fighting tooth and nail to get their offer accepted for any home that fit their needs and frustration was running high. As we closed out the year, inventory came up along with interest rates. Sellers started reducing the price of their properties and the days on market started to grow. Buyers began to pull back due to higher interest rates and listing prices of homes. We are still sitting low on inventory but it feels like the buyers are starting to have more power in the market.

In this video, I go in great depth on how the Missoula real estate market acted in 2022 and also my predictions on how I think the market will react in 2023. I have attached the slides at the bottom of this article for quick reference. After being in the real estate industry for nearly 20 years, I have seen a lot of ups and downs in the market. The last couple of years are something that I have never seen before, but after reviewing last year’s numbers and trends, I believe I have a good idea of what we can expect to see. Of course, I do not have a crystal ball so I am not going to say that this will defiantly happen. It is just what I believe will happen.

Missoula Real Estate Market predictions for 2023

As we venture into 2023, I would say that if you are on the fence about trying to buy now or waiting till spring to start looking, you should start looking now. A lot of buyers are waiting for spring to jump into the market. We are seeing more inventory coming available, fewer buyers, and prices softening in these winter months. This could give you an edge. At this time, we are keeping our eye on the list-to-sales price to stay around the 97%-98% range and the absorption rate to continue to trend toward the normalized market line. This first quarter is going to set the groundwork for the rest of the year.

We all know that interest rates are a huge factor in people choosing to purchase a home or not. As a good friend and lender told me the other day, “marry the house date the rate”. What that means is that if you find the house that checks all the boxes for you, there is a good chance that you can refinance once inflation curbs and the interest rates come down a bit. There are also other programs for home financing, like the 3-2-1 adjustable rate.

If you have any questions, please feel free to contact me at [email protected] or call (406) 926-6767

Thank you,

Jeremy Williams